how much are payroll taxes in colorado

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. - SocialSecurityOASDI is 62 until one has reached the wages limit of 128400 - Medicare is 145 of all wages up to 200000 an additional 09.

Income Tax Calculator Colorado Salary After Taxes Income Tax Payroll Taxes Tax

Detailed Colorado state income tax rates and brackets are available on this page.

. The income tax is a flat rate of 455. Small businesses with less than 100000 in retail sales need to transition to destination sourcing by October 1 2022. Denver 2021 Payroll Tax - 2021 Colorado State Payroll Taxes.

Deduct federal income taxes which can range. In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both employee and. This free easy to use payroll calculator will calculate your take home pay.

4 rows Online Payment in Revenue Online. Luckily the Colorado state income tax rate isnt quite as high. Payroll tax is 153 of an employees gross taxable wages.

Transition to Destination Sourcing Information. You may withhold 463 in lieu of using the withholding tax tables in this booklet. Both employers and employees are responsible for payroll taxes.

The median household income is 69117 2017. Colorado State Directory of New Hires PO. No standard deductions and exemptions.

Payment methods for withholding tax depend on how much total. The state income tax in Colorado is assessed at a flat rate of 450 which means that everyone in Colorado pays that same rate regardless of their income level. Companies who pay employees in Colorado should first register with the CO Secretary of State if not already registered to do business in CO then register online.

Check other than hisher regular payroll check you must withhold Colorado tax. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. Colorado Salary Paycheck Calculator.

Currently Colorado taxpayers can be exempted from paying state taxes on capital gains in some cases. However you can also claim a tax credit of up to 54 a max of 378. In fact the flat tax rate of 455 more closely resembles the Grand Mesa the worlds largest flat-top mountain.

The Colorado income tax has one tax bracket with a maximum marginal income tax of 463 as of 2022. In 2022 the Social Security portion of FICA remains at 62 for the employer and 62 for the employee for earned income up to 147000 per year. Box 2920 Denver CO 80201-2920.

Supports hourly salary income and multiple pay frequencies. Colorado Directory of New Hires. Have your employee complete this form which dictates how Colorado income tax is.

When is My Tax Return. Census Bureau Number of cities that have local income taxes. How Employee taxes are calculated.

Check the 2020 colorado state tax rate and the rules to calculate state income tax 5. What Is Local Income Tax Income Tax Income Tax. The standard FUTA tax rate is 6 so your max contribution per employee could be 420.

Complete this form to report your new employee to the State. That deduction will largely be eliminated starting in tax year 2022 forcing. Calculates Federal FICA Medicare and.

Please refer to the table below for a list of 2021 Payroll Taxes employee portion and employer portion that are applicable to the. Colorado income tax rate. No state-level payroll tax.

What Are Payroll Taxes And Who Pays Them Tax Foundation

Colorado W4 Form 2021 In 2021 Irs Forms Payroll Taxes Federal Income Tax

2022 Federal State Payroll Tax Rates For Employers

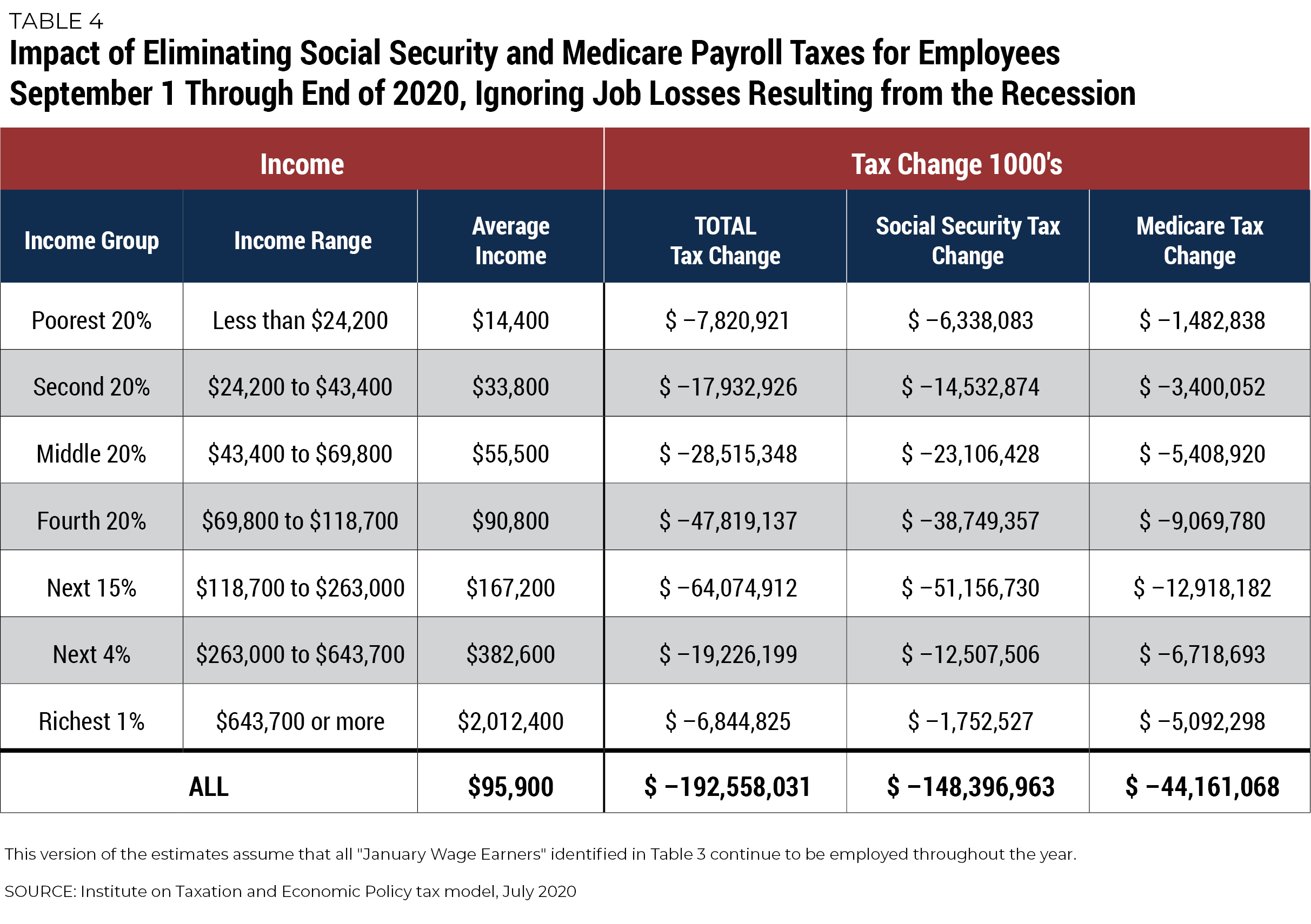

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Payroll Tax What It Is How To Calculate It Bench Accounting

This Quick Reference Guide To Business Taxes Give You A Better Understanding Of Why You Are Paying Certain Bookkeeping Business Business Tax Small Business Tax

Income Tax Vs Payroll Tax Infographics Here Are The Top 5 Differences Between Income Tax And Payroll Tax Payroll Taxes Payroll Income Tax

Trump S Proposed Payroll Tax Elimination Itep

The Deal With Gift Tax Small Business Tax Business Tax Tax Preparation